Introduction

Global stock markets have experienced heightened volatility in recent weeks, with major indices posting sharp declines amid a confluence of economic and geopolitical pressures. Investor sentiment has been rattled by renewed concerns over trade tensions, a slowdown in global growth forecasts, and shifting central bank policies.

Drivers of Recent Volatility

Recent declines in global stock markets can be attributed to several interrelated factors:

- Escalating Trade Tensions: President Donald Trump’s recent implementation of tariffs on imports from countries such as China, Canada, and Mexico has heightened fears of a global trade war, leading to increased market volatility and investor uncertainty.

- Global Economic Slowdown: Forecasts from organizations like Fitch Ratings and the OECD have downgraded global growth projections, signalling a potential economic slowdown that negatively impacts investor confidence and stock valuations.

- Weakening U.S. Consumer Confidence: Rising inflation and policy uncertainties in the U.S. have led to a decline in consumer confidence, prompting fund managers to anticipate an economic slowdown and reduce exposure to U.S. equities.

Tariff Update

The United States’ application of tariffs on imports from key trading partners – Canada, China, the EU and Mexico for starters – could slow global economic growth, weigh on equity markets, and disrupt vital supply chains.

Tariffs can impose a range of impacts on global economies and industries, from lower profit margins to higher costs to complicated supply chains. GDP growth could stall and inflation rise.

For some, the levies could lead to gains.

- GDP Down, Inflation Up: The tariffs announced Feb. 1 would lift the average US levy to 11.5% from 2.3%, raising the risk of a 1.3% drag on US GDP and a 0.8% increase in the Personal Consumption Expenditure index, the Federal Reserve’s favored inflation gauge.

- Stocks Could Struggle: Tariffs applied during President Trump’s first term, in 2018, were followed by weaker margin estimates and double-digit declines in global equities. It could be worse this time, given they’re likely to be more extreme and target a broader set of goods.

- Legal and Trade Challenges: Retaliatory duties from targeted countries pose another risk.

Source: Bloomberg Intelligence Global Tariffs 2025 Outlook

Australian Equities

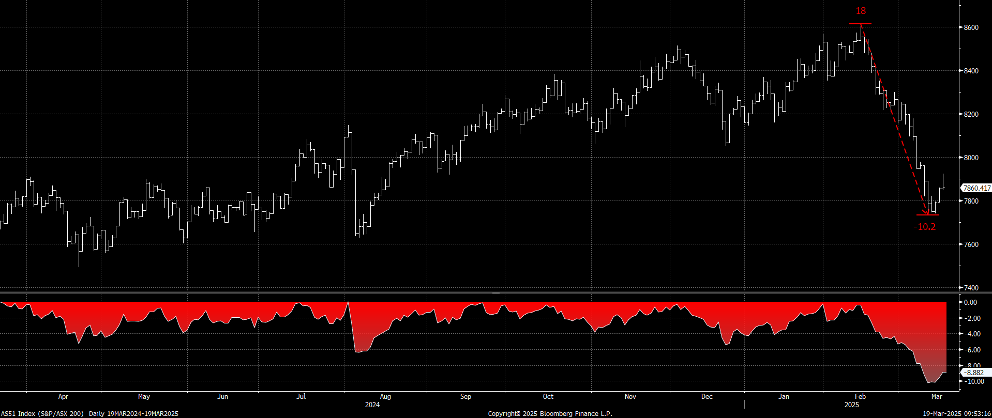

The S&P/ASX 200 fell 10.2% over 18 days, and despite a small rally this week, volatility has picked up (albeit from a low base).

Figure 3: 12 Month Chart of S&P/ASX 200

International Equities

The MSCI World Index fell 7.95% over 17 days, and similar to the Australian market, has seen a moderate rebound this week. For context, the index fell a similar amount (8.24% over 14 days) in July and August on fears of the unwind of the Japanese carry trade, so this level of volatility is not outside normal ranges.

Figure 4: 12 Month Chart of MSCI World Index

What This Means for Your Investments

Recent market volatility, driven by economic uncertainty, geopolitical risks, and shifting investor sentiment, highlights the importance of maintaining a disciplined approach to investing. While short-term fluctuations can be unsettling, staying focused on long-term financial goals is key. Here are a few considerations:

- Diversification remains crucial – A well-structured portfolio across asset classes such as equities, bonds, and alternatives can help manage risk and reduce the impact of market downturns.

- Short-term turbulence vs. long-term strategy – Markets often react sharply to economic and geopolitical developments, but history shows that long-term investment success comes from maintaining a well-thought-out strategy rather than making reactive decisions.

If you’d like to discuss how these market shifts may affect your portfolio, we’re here to provide guidance and help you navigate changing conditions.

Final Thoughts

Trade tensions and tariffs can create market noise, but they are just one factor influencing investment performance. While short-term volatility is expected, maintaining a well-diversified portfolio helps manage risk. If you have any concerns or would like to discuss your investment strategy, please don’t hesitate to reach out. We’re here to help you stay informed and confident in your financial decisions.