What Happened?

As the dust settles on the recent U.S. election, we are starting to see early market reactions to the re- election of Donald Trump as President. This outcome marks a potential shift in U.S. economic policies, which in turn could have implications for global markets, including Australia. In this note, we’ll walk through key areas to watch under a Trump administration and explore what these could mean for markets and your portfolio.

It is worth highlighting that betting markets has installed Trump as the favourite to win the Presidency by varying degrees, and markets associated with the “Trump Trade” had rallied into the election, so if the market reaction appears somewhat subdued, it is due to the fact that markets were already pricing in a relatively high probability of Trump winning before a vote was counted.

Furthermore, we believe that the rally overnight (Wednesday night Australian time) was in some part driven more by the fact that the result was fairly decisive, rather than who won. With limited uncertainty about the count continuing for days whilst the world waited for a result, markets were able to take some comfort in the anticipated orderly transfer of power.

Market Reactions So Far

Markets have reacted with a mix of volatility and cautious optimism. Here are some of the most noticeable shifts:

• Equities – U.S. equities initially responded positively, with a focus on sectors likely to benefit from the administration’s pro-business stance. Financials, energy, and infrastructure-related stocks have seen gains as investors anticipate lighter regulations and potential tax cuts. US Equity Futures rallied through the period where votes were counted.

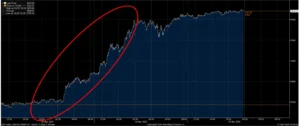

• Fixed Income – Yields on U.S. Treasuries moved higher (bond prices lower) as investors priced in the likelihood of increased government borrowing to fund ambitious spending programs. Higher U.S. yields could put pressure on Australian bonds, potentially leading to higher borrowing costs domestically. The chart below outlines the US Government 10 Year yield moving higher as it became clearer that Trump was likely to win the election.

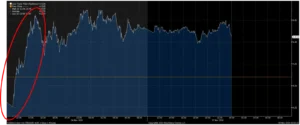

• Commodities – Oil prices saw volatility throughout the count, with expectations of reduced regulation on the U.S. energy sector and a possible return to policies supportive of domestic fossil fuel production. Oil prices swung dramatically through the night as the outcome became clearer.

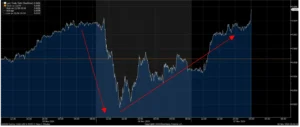

• Currency – The U.S. dollar initially strengthened as investors anticipated higher growth and inflation in the U.S., which could lead the Federal Reserve to tighten monetary policy. A stronger US dollar can boost Australia’s export competitiveness but also make overseas investments relatively more expensive for Australians. Interestingly, the AUD has rallied on Thursday, essentially reversing the initial US Dollar rally.

Key Policy Areas to Watch

There is obviously some uncertainty around which policies will be implemented and what compromises will be required to enact them, however at this stage it appears that the Republicans may hold the Houe and Senate in addition to the Presidency, making it easier to implement their policies this term:

• Tax Policies: Trump’s previous administration focused on tax cuts, and a similar approach is expected again. If corporate taxes are lowered further, U.S. companies could see higher profits, potentially driving U.S. stock prices. Australian companies with U.S. operations might benefit from a reduced tax burden, though any competitive advantage may lessen if local corporate taxes remain unchanged.

• Trade and Tariffs: A hallmark of Trump’s past administration was a more protectionist trade policy, particularly with China. If trade tensions are rekindled, it could lead to supply chain disruptions and potentially impact Australian companies reliant on Chinese demand or U.S.-China trade relations. However, any movement toward bringing manufacturing back to the U.S. could benefit sectors like technology and raw materials.

• Infrastructure Investment: A significant infrastructure plan could spur demand for materials and construction, creating an indirect opportunity for Australian resource exporters. However, such spending would likely require more borrowing, which could drive up U.S. interest rates and lead to stronger inflation expectations globally.

• Energy and Environmental Policies: Trump’s prior approach favoured fossil fuels over renewable energy, and a renewed emphasis on this could shape energy markets. While this could mean lower regulation for traditional energy sectors, it may also impact investments in renewables. Australian energy exporters could benefit if U.S. demand increases, though a possible decline in global environmental cooperation might impact climate-focused investments.

• Monetary Policy and Federal Reserve: While the President does not directly control Federal Reserve policy, a return to Trump’s more vocal approach toward encouraging low interest rates could create more market volatility around Fed decisions. An accommodative Fed policy could support further equity gains but could pose inflationary risks, potentially affecting both U.S. and Australian markets.

Implications for Australian Investors

While the exact impact on Australian markets remains to be seen, here are some considerations:

• Diversification remains key. While certain sectors may perform well under a pro-business U.S. administration, it’s crucial to maintain a well-diversified portfolio to weather any sector-specific volatility.

• Opportunities in Commodities and Resources – With the U.S. potentially increasing demand for infrastructure and energy, there could be upside for Australian commodity exports. Monitoring exposure to this sector could offer opportunities for tactical allocation.

• Currency Effects – A stronger U.S. dollar could boost Australian exports but might also introduce volatility to international investments.

• Fixed Income Positioning – Rising U.S. yields might lead to upward pressure on Australian bond yields. As interest rates rise, fixed income portfolios should be positioned carefully to manage potential duration risk.

Staying the Course

Market volatility is often an immediate reaction to political change, but as always, it’s crucial to take a long-term perspective. Our focus will remain on understanding the evolving policy landscape and positioning portfolios to manage risk and seize opportunities as they arise.

While the U.S. election outcome is significant, it’s essential to remember that other, often more substantial, factors are likely to influence markets in the coming year. Among these, inflation and central bank policy continue to take center stage. In 2024/2025, the trajectory of interest rates, especially if inflation remains persistent, will be a critical driver. Additionally, China’s economic recovery, commodity price trends, and ongoing technological shifts will all shape market dynamics.

US Fed Cuts Rates by 0.25%

As expected, the FOMC continued is recently initiated rate cut cycle with a further 0.25% cut overnight (Thursday night Australian time). With inflation broadly under control, it appears that the Fed is now starting to focus on the full-employment aspect of their mandate and the market is pricing in 75% chance of a further 0.25% cut in December. Fed Chair Powell was asked about the potential impact of the new administration on the rate path, and his response was “In the near term, the election will have no effects on our policy decisions”.

We expect that the Fed is likely to continue cutting rates gradually as inflation eases. The Republican victory in the presidential election and their likely sweep of Congress and the Senate suggests expansionary fiscal policies are likely — something that could make Fed policymakers more cautious in their rates outlook in December’s dot plot.